Spring is here . .and, here I am in (snowy!) Minneapolis to present XBRL to an investor relations audience with Dan Roberts, Chair XBRL US. Dan's day job is Director, Assurance Innovation (hmm oxymoran if ever I saw one!) at Grant Thornton. Dan led me to appreciate that we must strive to create new ways of challenging ourselves and our children and to that point imparted his love and mastery of the unicycle. Dan is a very engaging speaker and always warms the audience with his personal experiences in life. Also joining us in our lively discussion was Garry Lowenthal for Viper Powersports Inc. (Pinksheets: VPWS). Garry is a very affable guy and has over twenty years of senior operations & finance experience, having served as a CEO, COO, and CFO, with a record of facilitating acquisitions, business launches, IPO’s, reorganizations and turnarounds while driving rapid revenue production. BTW, if you ever want to check out of the rat race and join the life of extreme sports -- you must take a peep at Garry's company and his custom bikes.

As I left my hotel for the meeting, I glanced at the FT headline and lobed a copy into my bag as I headed into the Mpls snowstorm. The headline was timely as Pfizer and others were clearly making noises about earnings forecasts pandering to sell side analysts. Opposition grows to earnings forecasts as Pfizer is the latest group to scrap quarterly guidance. -Financial Times March 13, 2006.

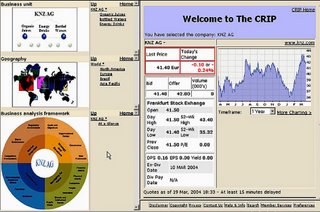

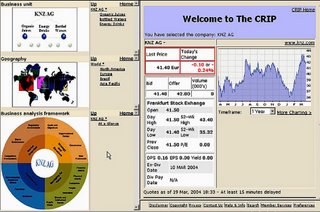

The backdrop to this headline is the recent spate of news about the continued convergence of the buy and sell-sides and the potential economic annihillation of sell side business. Some major bulge bracket firms derive as much as 75% of their revenues from principal transactions today. Firms that have traditionally relied on agency transactions as their bread and butter are now also starting to indicate they will start to leverage their balance sheets to act as principal. The unbundling of research and trading in the domestic equities business along with a greater reliance among publicly traded Investment Banking & Brokerage firms to derive earnings growth through principal transactions will likely lead to a further convergence of the buy and sell-sides of the business. Block trading, the specialist system, and the experienced institutional salesman many become a thing of the past as a result. Sell-side research is likely to continue to become more short-term oriented and even rare. More reason for publicly traded companies to take the initiative and market their companies more aggressively and consistently than before -- hence the real time dashboard or some corollary may become more relevant.

No comments:

Post a Comment